by CC Admin | Vehicle Insurance

As global transportation trends move toward sustainability, electric vehicles (EVs) have experienced substantial growth in India’s automotive market. This expansion has created demand for specialized insurance products designed to address the distinct...

by CC Admin | Accident Insurance

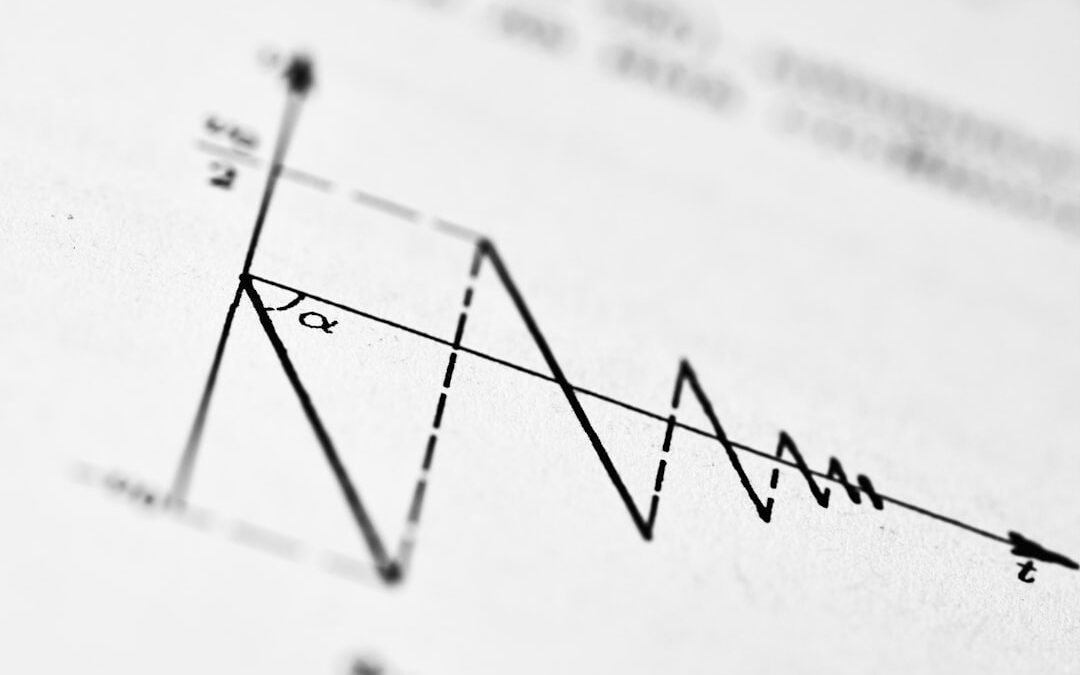

Accident insurance serves as a crucial safety net, providing financial protection in the event of unforeseen mishaps. When you consider purchasing an accident insurance policy, one of the most significant aspects to understand is how premiums are determined. Various...

by CC Admin | Vehicle Insurance

When purchasing a vehicle, the Insured Declared Value (IDV) is a fundamental component of motor insurance that requires careful consideration. The IDV represents the maximum compensation amount an insurance company will provide in cases of total loss, theft, or...

by CC Admin | Accident Insurance

Group accident insurance is a type of coverage that provides financial protection to a collective of individuals, most commonly employees within an organization, when they experience accidental injuries or death. This insurance differs from individual accident...

by CC Admin | 4 Wheeler Insurance, Vehicle Insurance

Agreed value coverage is a specialized insurance option for vintage and classic cars with historical or sentimental significance. Unlike standard auto insurance that pays actual cash value minus depreciation, agreed value coverage establishes a specific vehicle value...